Financial Reports

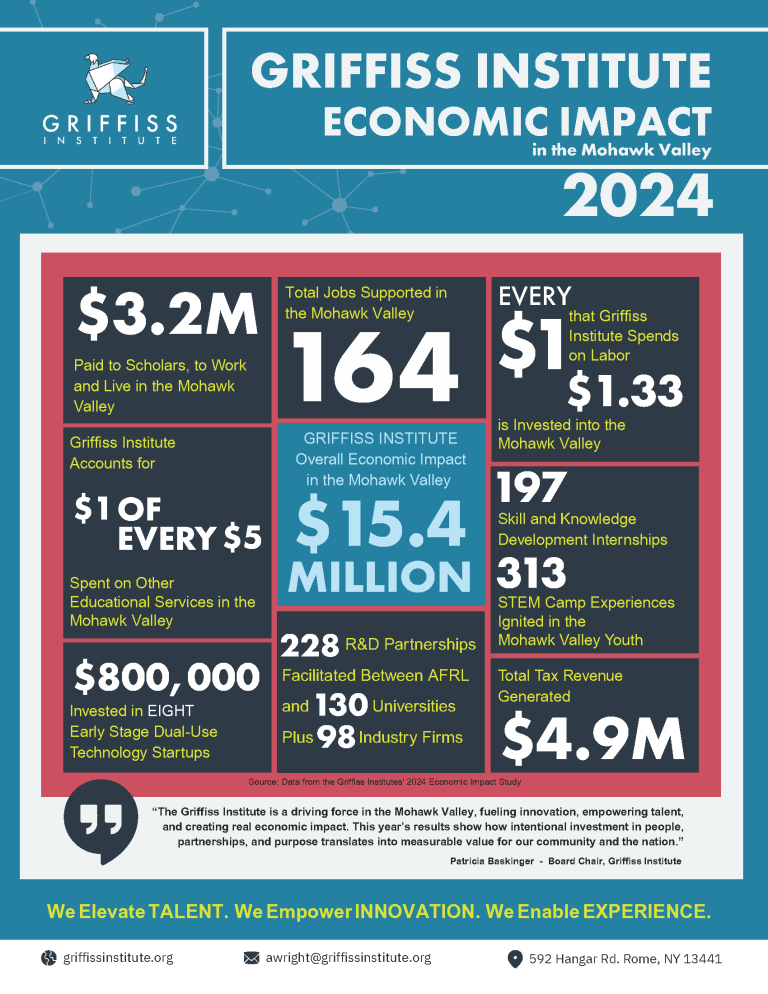

Griffiss Institute Economic Impact Report 2024: As a steward of national security innovation and regional economic growth, the Griffiss Institute is committed to demonstrating the measurable value our work delivers to the Mohawk Valley, New York State, and the nation. Economic impact reports provide a data-driven assessment of how an organization contributes to its surrounding economy, capturing not only the direct outcomes of jobs supported, revenue generated, and programs delivered, but also the broader ripple effects created through local spending, supplier engagement, workforce development, and new business activity.

This year’s analysis is strengthened through the contributions of student researchers from Hamilton College’s Arthur Levitt Public Affairs Center, whose rigorous approach and commitment to public-interest inquiry helped illuminate the full scope of Griffiss Institute’s economic influence. Their work, alongside Griffiss Institute, reflects the very pipeline of emerging talent we strive to cultivate, young leaders advancing skills, insights, and innovation for the benefit of our region and nation.

This report offers stakeholders, policymakers, and investors a clear understanding of Griffiss Institute’s role as an economic catalyst, illuminating how our mission, partnerships, and programs translate into tangible benefits for the communities we serve and the national security enterprise we support.

Complete the form to access the full report:

About the GI

Strategic Plan: A strategic plan focuses on the long-term vision and goals of an organization. It is broad and high-level, typically covering a time span of three to five years. The purpose of a strategic plan is to set the overall direction and priorities for the organization, defining what it aims to achieve and the strategies to get there. Key components include mission and vision statements, key objectives, strategic initiatives, and long-term goals. For example, a strategic plan might outline goals for expanding partnerships, enhancing community engagement, and growing organizational capacity.

Operating Plan (2025): An operating plan focuses on short-term actions and detailed implementation. It is specific and detailed, usually covering a one-year period. The purpose of an operating plan is to translate the strategic plan into actionable tasks and daily operations, detailing how the strategic goals will be achieved in the short term. Key components include specific projects, tasks, timelines, resource allocation, and performance metrics. For example, an operating plan might list specific events to host, training sessions to conduct, budget allocations, and staff assignments to support the strategic goals.

501(c)3 Designation Letter: An official document issued by the IRS confirming an organization’s tax-exempt status under section 501(c)(3) of the Internal Revenue Code. This letter verifies the organization is recognized as a nonprofit, eligible to receive tax-deductible charitable contributions, and exempt from federal income tax.

Certificate of Incorporation: A legal document filed with the state government that officially establishes a corporation as a legal entity. It outlines key details such as the organization’s name, purpose, structure, and date of formation, and serves as foundational proof of its existence.

Financial Reports

Form 990 (2024): An annual information return required by the IRS for tax-exempt organizations, such as charities and nonprofits, to provide transparency about their operations, finances, and compliance with tax regulations. It includes details like revenue, expenses, executive compensation, and activities to ensure the organization maintains its tax-exempt status. The form helps donors, regulators, and the public evaluate how effectively the organization is using its resources.

Audited Financial Statements (Last 5 Years): An audited financial statement for a nonprofit is a comprehensive report that provides a detailed overview of the organization’s financial activities and status, verified by an independent auditor. This document is crucial for maintaining transparency and accountability, especially for stakeholders such as donors, grantors, and regulatory bodies. It typically includes several key components. The Independent Auditor’s Report contains the auditor’s opinion on whether the financial statements are presented fairly in accordance with generally accepted accounting principles (GAAP), assessing the accuracy and completeness of the organization’s financial records.

Coming Soon!

Single Audit (2024): A single audit, also known as the Office of Management and Budget (OMB) Uniform Guidance Audit, is a detailed examination of a nonprofit organization’s financial statements and federal award expenditures conducted by an independent auditor. This type of audit is required for nonprofits that expend $750,000 or more in federal funds annually, ensuring compliance with federal regulations and program requirements.

IRS Form 990 Required for Tax-Exempt Organizations (Last 5 Years): IRS Form 990 is a crucial document that tax-exempt organizations in the United States must file annually with the Internal Revenue Service (IRS). This form provides the IRS and the public with essential information about the organization’s mission, programs, and finances, ensuring transparency and accountability.

Coming Soon!